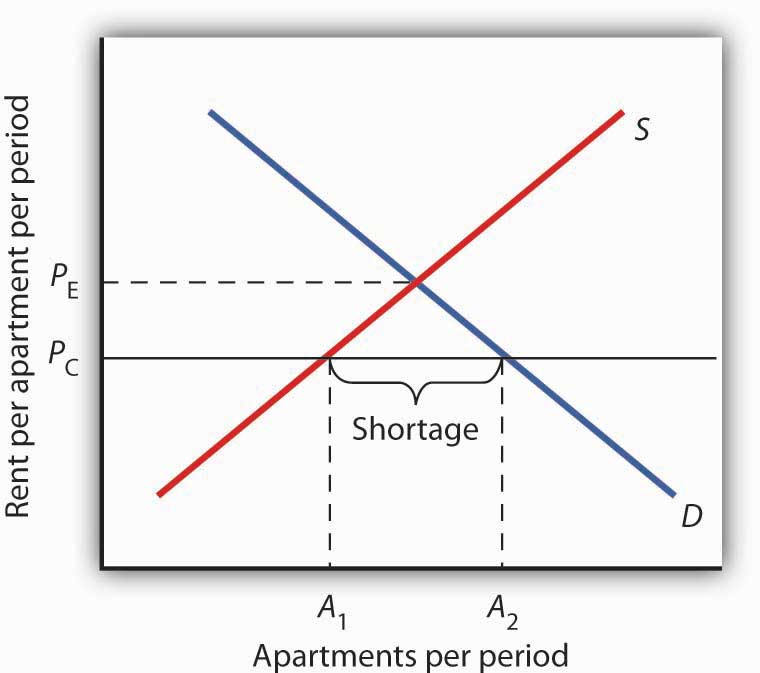

Why does a price ceiling set below an equilibrium price tend to cause persistent imbalances in the market.

Price ceilings cause persistent price floors cause persistent.

Neither price ceilings nor price floors cause demand or supply to change.

They are usually put in place to protect vulnerable buyers or in industries where there are few suppliers.

Before considering an example of price floors minimum wages let s examine the problem in general terms.

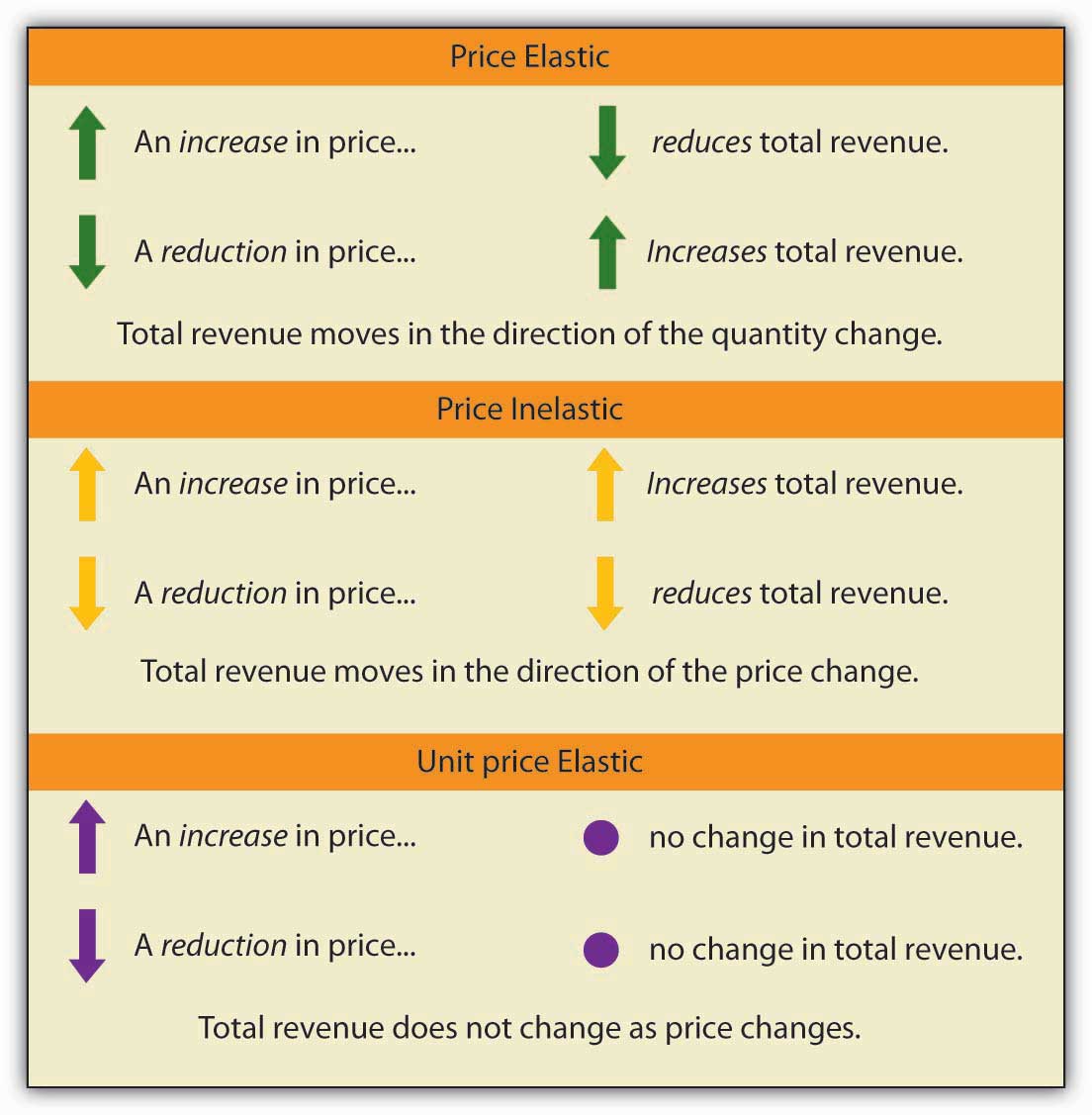

If the price of a product is above the equilibrium price the result will be allocative efficiency.

Price ceilings cause shortages and higher costs.

Price ceilings impose a maximum price on certain goods and services.

For more on the minimum wage.

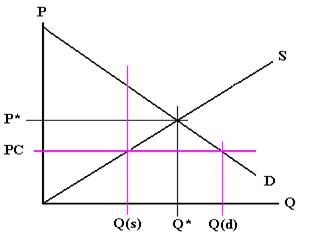

Because quantity demanded exceeds quantity supplied but price cannot rise to remove the shortage.

A binding price ceiling will cause a persistent and a binding price floor will cause a persistent.

Suppose congress imposes a price ceiling of 5 per atm transaction.

Price ceilings cause persistent.

In the accompanying figure the demand curve d and supply curve s determine a price p which the market tends toward.

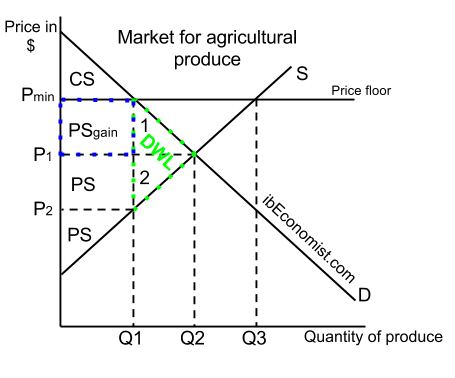

The graph below illustrates how price floors work.

Price floors cause persistent a surplus of a good.

Like price ceilings price floors disrupt market cooperation and have consequences quite different from those advertised by their advocates.

Where marginal benefit marginal cost.

If the average market clearing price for an atm transaction.

Price ceilings harm most consumers sunday november 1 1998.

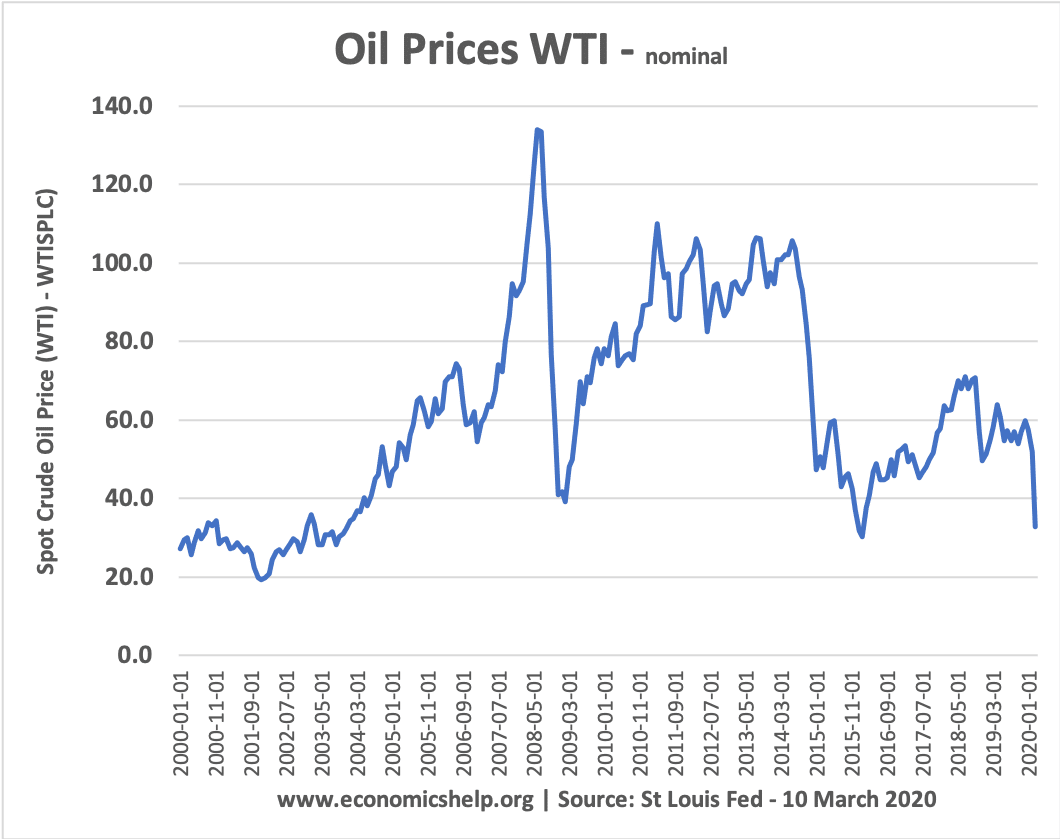

A good example of this is the oil industry where buyers can be victimized by price manipulation.

:max_bytes(150000):strip_icc()/WhyYouCantInfluenceGasPrices3-257334e47bc54cd7a449da9df90814af.png)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Price_Elasticity_Affect_Supply_Feb_2020-01-08f0b93e209c4c27a601d6a376dd6aff.jpg)